Few key highlights of the Business Week

Notice: Undefined index: catFilterList in /home/zambi/public_html/wp-content/plugins/wp-likes/api.php on line 243

Kelvin Chisanga Pastor CK with Caesar Edward Sindele at Pan African Radio

By Kelvin Chisanga, Zambian Economist and Communications Specialist +260 97 9305194

THIS business week ending today – Saturday 2nd October, 2021 has seen a couple of activities on both political and economic sides, this is the week which has seen the settling of full cabinet office bearers after appointment of the chief legal government officer who’s popularly known by the title of Attorney General, Mr. Mulilo Dimas Kabesha and Mr. Marshal Mubambe Muchende as Solicitor General, as the president returned this week from UNGA20 Summit which took place in New York, where he had gone alongside with two ministers, having various stakeholders on card for both multilateral and bilateral meetings.

Flashback: Bank of Zambia Governor, Dr. Denny Hamachila Kalyalya and BoZ Deputy Governoer Operations, Dr. Bwalya Kanyanta Emmanuel Ng’andu with Finance Minister Alexander Bwalya Chikwanda and Special Assistant to the President for Press and Public Relation, Amos Chanda

However, the just ended week has also seen with the developments on the monetary authority side, as the head of state made a re-appointment of Dr. Denny Hamachila Kalyalya to the position of Central Bank Governor, this is in an effort to bring back the much required lucidity and creditability to the country’s macroeconomic environment.

President Hakainde Hichilema and First Lady Mutinta Hichilema

This week saw President Hakainde Hichilema showing some signs of confidence to Zambia’s economy though it will take some significant period of time to see the triggering factor on real term economic growth, considering challenging economic aspects surrounding national debt portfolio coupled with economically depressed movements resultant of the global pandemic outlook of Coronavirus (COVID-19).

Kwacha’s performance in this week has been poorly structured, the currency made some marginal losses on Tuesday 28th September, 2021, during the course of this particular business week, and has shown very little capacity to outweigh demand pressures.

The Zambian Kwacha has shown slow movements due to weak fundamental support base, the US Dollar has put up a very strong demand following some relatively constant supply constraints on the local market, though in the interim, we have seen supply of forex strongly supported by the central bank which for some time now, has been the main source of forex inflows on the market.

It is advisable that the nation should moderate a quick way, and should deploy a systematic operational model to avoid central bank’s constant involvements as this poises an unnecessary moderations and interventions on forex support activities and supplies, as this will not create a sure way of generating standard supply-demand moderating channels within the domestic economy.

We can’t therefore keep on supporting Kwacha’s performance levels through some mechanical means or through the use of invisible hands when fundamentals are seen poorly reactive, instead we really need to access where we can fully engage and leverage on some economic benefits to encourage “natural” US Dollar inflows into the country by having an open-door investment policy up to a certain threshold emanating from the most productive sectors such as transport, agriculture, hospitality, mining, commerce and trade. The United Party for National Development (UPND) Alliance New Dawn Adminstration should take keen interests by ensuring that they bring forth strong political will to help in driving diversification of the economy.

This has been a busy and overwhelming insurance annual week in which most of the insurance companies and brokers alike, were commemorating activities within the circles of insurance sector under a theme: “creating a confident future with insurance“, though it is much surprising that two of the most prominent insurance outfits on the market have faced lawsuit for failing to honour on their claims. And this does not send a good signal if the consensus is not quickly reached with these insurance firms and their disputable case with respective clients seeking remedy.

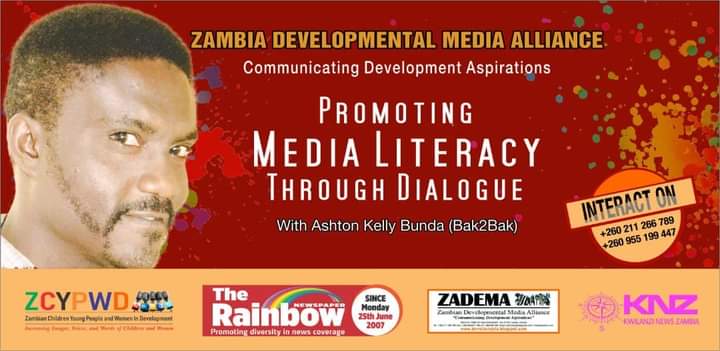

Zambian Developmental Media Alliance (ZADEMA) +260955199447, +260977199447,+260969964499 and +260211266789