Notice: Undefined index: catFilterList in

/home/zambi/public_html/wp-content/plugins/wp-likes/api.php on line

243

Post Views: 2,117

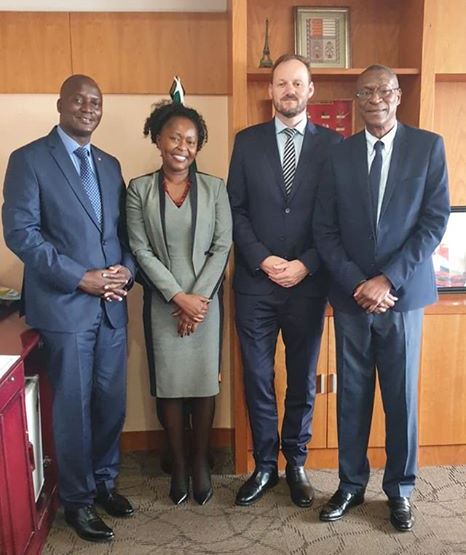

Mines and Minerals Development Ministry Permanent Secretary Barnaby B. Mulenga with Minister Richard Musukwa

By Kwilanzi News Zambia

THE Zambian Government through Minister of Mines and Minerals Richard Musukwa aand his Permanent Secretary Barnaby Mulenga has upped the ante in its dispute with Glencore by detaining the head of its local subsidiary as he tried to leave the southern African country on Wednesday evening on 15th April 2020.

Glencore said Nathan Bullock, the Chief Executive Officer (CEO) of Mopani Copper Mines, in Zambia had been held at Lusaka Kenneth Kaunda International Airport (KKIA) in connection with its decision to shutter the business for three months (90 days).

“Nathan Bullock has subsequently been released,” Glencore said in a statement, adding that Mr. Bullock had been on his way home to spend time with his family in Australia when he was detained.

Mr. Nathan Bullock’s detention came hours after Zambia threatened to strip Glencore of its licence to operate in the country and sharply escalates the increasingly bitter dispute over Mopani Copper Mines.

Last week, Glencore announced the closure of loss making Mopani for three months because of low commodity prices and the coronavirus pandemic.

Mopani Copper Mines CEO Nathan Bullock

President Edgar Lungu greets Mr Richard Musukwa Minister of Mines and Minerals Development during the Swearing at State house -Pictures by Eddie Mwanaleza

That move that drew a furious response from Zambia’s Mining and Minerals Minister Richard Musukwa, who slammed it as unjustified and illegal. Zambia has a large debt burden to service and earns most of its foreign exchange from copper exports.

In a letter dated Tuesday April 14th 2020, to Mr. Bullock, Zambia’s Mining Licensing Committee said it planned to revoke the company’s operating permits for the Nkana and Mufulira mines in seven days unless it could show why they should not be cancelled.

Zambia runs the risk of another busted flush if it moves to expropriate Mopani, since it has still yet to secure a new buyer for Vedanta’s Konkola Copper Mines 11 months after the provisional liquidator took charge Nick Branson, Verisk Maplecroft

Glencore owns 73.1 per cent of Mopani. The other shareholders are First Quantum Minerals with a 16.9 per cent stake and government-controlled Zambia Consolidated Copper Mines Investment Holdings (ZCCM-IH), with 10 per cent.

“The Mining Licensing Committee is in receipt of an investigation report by the Director of Mines which has established that you have proceeded to place the Nkana and Mufulira mines on care and maintenance without giving sufficient notice as required by law,” said the letter, seen by the Financial Times.

Glencore said it was committed to engaging in a constructive dialogue with the Zambian authorities. The Swiss-based company has invested more than $4bn in the country since 2000.

Zambia’s threat to revoke Glencore’s mining licence comes as the government of President Edgar Lungu struggles to service its debt load.

Former ministers and officials on Wednesday urged the country to seek a loan from the IMF. The country has $11bn of external debt.

KCM CEO Steven Din assures H.E Emmanuel Mwamba on payments to suppliers and Re-employing workers

Mr. Lungu has previously taken a tough line against international mining companies. Last year the government placed Konkola Copper Mines into liquidation, accusing its owner Vedanta Resources of breaching the terms of its mining licence.

Vedanta has denied the charges and taken its case to international arbitration, a route Glencore may also be forced to take if the dispute escalates.

“This is an ill-conceived move at a critical time for Zambia,” said Peter Leon, partner at law firm Herbert Smith Freehills.

Nick Branson, senior Africa analyst at Verisk Maplecroft, said Zambia’s ultimatum to Glencore was the latest in a long line of “populist threats” from a heavily indebted government fearful of lower copper earnings at a time when it was battling to avoid sovereign default.

The Commodities Note Neil Hume

Prospects of global recession and demand shock hit mining stocks

“We see scope for compromise given the state’s weak hand and the miner’s deep pockets,” he said. “Zambia runs the risk of another busted flush if it moves to expropriate Mopani, since it has still yet to secure a new buyer for Vedanta’s Konkola Copper Mines 11 months after the provisional liquidator took charge.”

He added that he expected the Zambian government “to push for tax advances from Glencore, rather than pursue expropriation and end up with a second unprofitable mine on its books.”

Mopani is one of Glencore’s “focus” assets and a key plank of a wider plan to transform the performance of its African copper unit, which also includes mines in the Democratic Republic of Congo (DRC). It employs 11,000 people, including contractors.

The group is close to finishing a multi-billion-dollar investment plan aimed at increasing Mopani’s production to 140,000 tonnes a year and placing the business on a more sustainable footing.

ZCCM-IH Board Appoints Mabvuto Chipata as CEO

Mopani has struggled for years against a tough operating and regulatory backdrop in Zambia.

Its two mines had been expected to produce between 50,000 and 70,000 tonnes this year, worth between $255m and $357m at current copper prices. It is among a growing number of copper assets that have been closed because of the Covid-19 pandemic.

Glencore has promised to pay its permanent Zambian employees, excluding management, while Mopani is closed.

Be the first to like.

Be the first to like.