Notice: Undefined index: catFilterList in

/home/zambi/public_html/wp-content/plugins/wp-likes/api.php on line

243

Post Views: 21,987

By Bernadette Deka – Policy Monitoring Research Centre (PMRC) Executive Director

On Friday 28th September 2018, the Minister of Finance, Honourable Margaret D. Mwanakatwe, and MP delivered the 2019 Budget address to the National Assembly under the theme “Delivering Fiscal Consolidation for Sustainable and Inclusive Growth”.

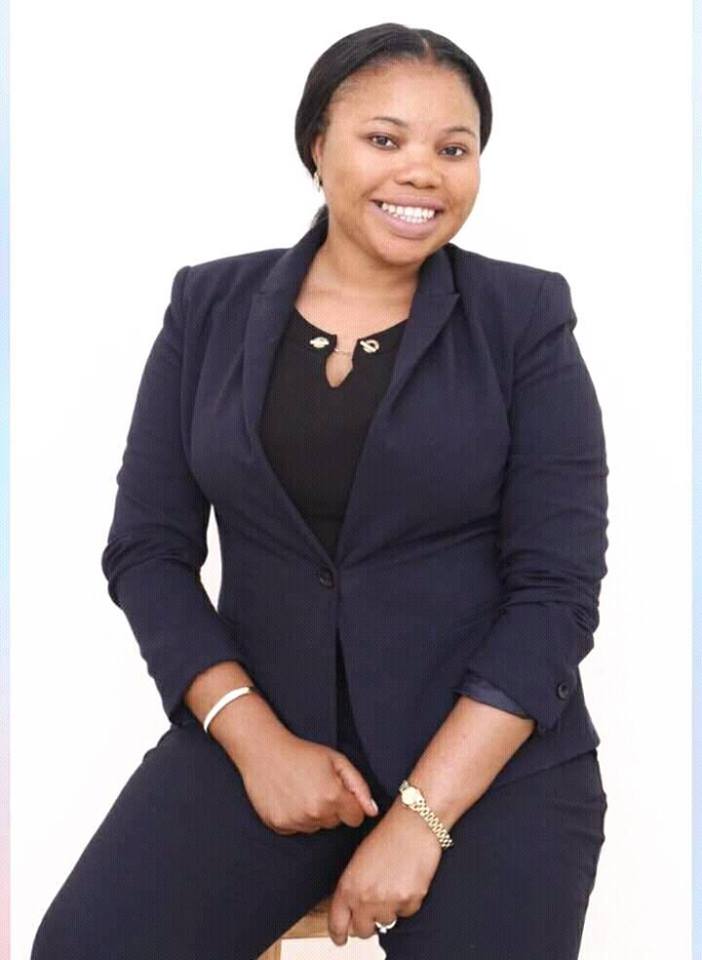

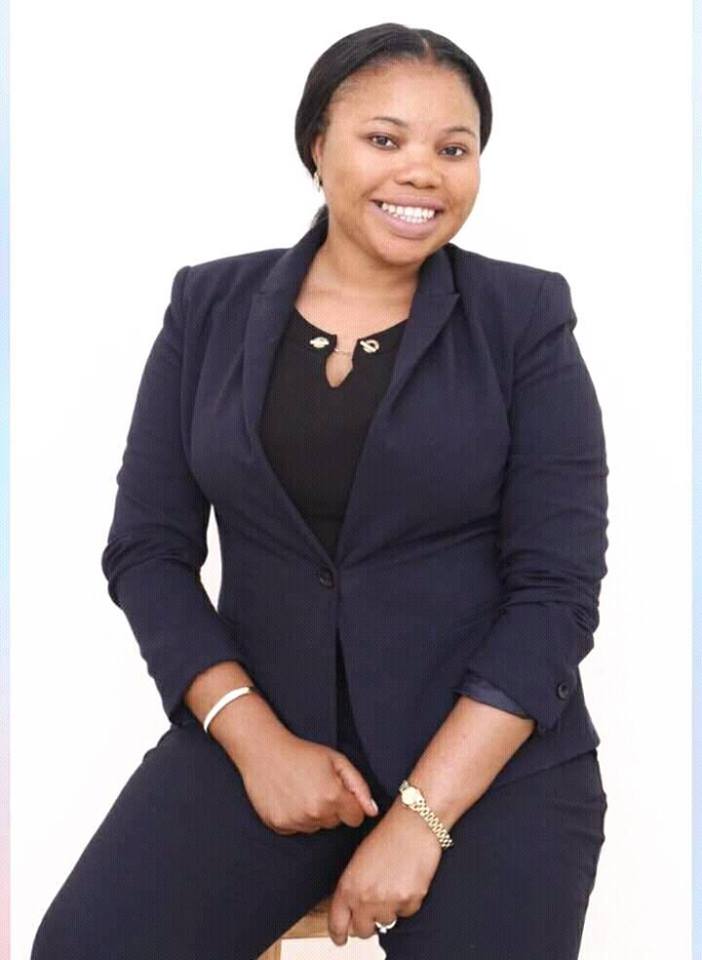

Deka Bernadette

The 2019 National Budget was formulated against the backdrop of the austerity measures being implemented by Government to deliver fiscal consolidation.

Among several observations, the budget proposes bold and substantial changes in revenue mobilisation and spending strategies in support of the goal for fiscal consolidation.

The budget is aligned to the Economic Stabilization and Growth Programme, the Seventh National Development Plan (7NDP), and the vision of becoming a prosperous middle- income country by 2030.

PMRC has since produced the 2019 National Budget analysis, which explains key aspects of the Budget in all the 5 pillars of the Seventh National Development Plan and further provides recommendations to aid with the implementation of the Budget.

Finance Minister , Hon. Margaret Mwanakatwe, who is also Lusaka Centre MP, pictured with her Husband Mpanga Mwanakatwe upon arrival at Parliament to Present the 2018-19 Budget

NOTE: 5 pillars of the 2017-2021 Seventh National Development Plan (7NDP) And Price Waterhouse Coopers in their budget analysis gave a note on each of the five pillars as stated below:

1. Economic diversification and Job creation:

Part of the diversification for agriculture involves the creation of a number of farm blocks in the #Copperbelt, #Muchinga and Northern provinces. The model seems to be based on a concept of transferring skills and technology, and leveraging from the private sector commercial practices to create local community-based integrated agricultural activities; these are not just limited to conventional farming but include vertical distribution and value-added facilities which smallholder farmers can participate in. The key benefits targeted are job creation and social development

It is good news to learn that the much talked about e-voucher system will be fully implemented in the 2017/18 farming season to cover over one million farmers. The migration to the e-voucher is expected to assist in eliminating ghost farmers. The migration to the e-voucher is expected to assist in eliminating ghost farmers and duplication of beneficiaries. Once established, the system should enhance access to farm inputs and promote agricultural diversification.

Road development will continue under the Link Zambia 8,000, the Lusaka 400 and Copperbelt 400 projects. The critical Lusaka-Ndola dual carriageway is in two phases: the first is road construction tobe followed by auxiliary infrastructure such as hotels, toll gates and service stations.

2. Reducing Poverty and Vulnerability

More good news in Pillar 2 on the Social Cash Transfer Scheme. The already increased coverage and monthly payments to beneficiary households will in 2018 be further increased from 590,000 households in 2017 to 700,000. In addition, Government will fully migrate to an electronic social cash transfer platform which should result in more effective delivery.

3. Reducing Development Inequalities

Decentralisation plans in Pillar 3 should also be popular, with Government planning to see to it that finances required to provide front-line services and infrastructure projects are de-concentrated to provincial administration.

Local people will be involved in project planning and monitoring, and there will be devolution of powers from central government to lower level structures.

4. Enhancing Human Development:

The three components in Pillar 4 given as key to human development – health, education and skills, and access to water supply and sanitation – tend to be identified in the Budget by new buildings and other infrastructure, all of which are good and necessary.

5. Creating a Conducive Governance Environment for a Diversified and Inclusive Economy.

Measures announced in Pillar 5 to attain fiscal fitness, better social protection, a simpler and fairer way to expand the tax system must be commended. If implemented effectively and promptly these measures should provide a strong platform for enhancing the economic and social trajectory for this nation. The measures, which include revisions to the Public Finance Act (more punitive actions against abuse of misapplication of funds), the Public Procurement Act (to improve prices and project appraisal prior to granting of tender approval), and the Planning and Budgeting Bill (legal framework for managing public resources), should go a long way in tackling “the Difficult”.

http://www.pmrczambia.com/wp-content/uploads/2018/10/PMRC-2019-National-Budget-Analysis.pdf

Be the first to like.

Be the first to like.