MPC’s Policy Adjustment to Curb Inflationary Pressures

Notice: Undefined index: catFilterList in /home/zambi/public_html/wp-content/plugins/wp-likes/api.php on line 243

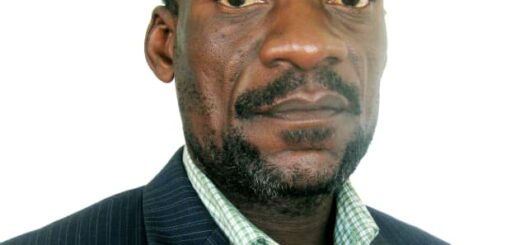

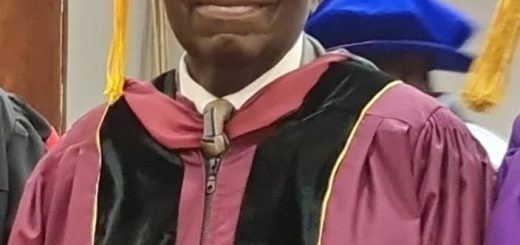

Dr. Denny Hamachila Kalyalya, Governor of the Bank of Zambia (BoZ). Wednesday 14th February 2024 Picture by Francis Maingaila

Dr. Denny Hamachila Kalyalya, Governor of the Bank of Zambia (BoZ). Wednesday 14th February 2024 Picture by Francis Maingaila

Bank of Zambia (BoZ). Wednesday 14th February 2024 Picture by Francis Maingaila

By Francis Maingaila

Lusaka, Zambia24 (14-02-2024) -The Monetary Policy Committee (MPC) has recently made a significant announcement, increasing the Policy Rate by 150 basis points to 12.5 percent. This decision aims to address the mounting inflationary pressures and ensure that inflation expectations stay within the target band of 6-8 percent.

Dr. Danny Kalyalya, Governor of the Bank of Zambia (BoZ), emphasized in a media briefing the influential role central banks play in stabilizing economies during economic turbulence.

He highlighted the strategic nature of the MPC’s decision to adjust the Policy Rate in response to prevailing challenges, stressing the importance of reinforcing economic resilience.

Dr. Kalyalya pointed out the escalating inflation, driven by currency depreciation and rising food and energy prices, as a significant threat to economic stability.

The decision to increase the Policy Rate is aimed at mitigating inflationary pressures and anchoring inflation expectations within the targeted range, Dr. Kalyalya explained.

He underscored the challenges in the foreign exchange market, evident in the depreciation of the local currency against major counterparts.

In addition to the rate adjustment, Dr. Kalyalya outlined the MPC’s measures, including providing market support and adjusting reserve ratios, as part of a comprehensive strategy to address forex market volatility.

Despite challenges, Dr. Kalyalya noted the robust credit expansion, driven by increased lending to the private sector, particularly in sectors such as mining, agriculture, and wholesale/retail, which contribute to economic growth.

He expressed optimism about medium-term growth prospects, citing potential avenues for economic recovery.

Dr. Kalyalya emphasized that the MPC’s decision-making process is informed by a thorough assessment of various factors, including financial stability, inflationary trends, and growth prospects. Encouraging developments, such as ongoing fiscal consolidation efforts, provide a favorable backdrop for sustainable macroeconomic stability, he added.

Vigilance remains paramount as the MPC continues to monitor evolving economic indicators, ready to take further action as needed.

Dr. Kalyalya concluded by highlighting the pivotal role central banks can play in guiding economies towards stability amidst turbulent times, explaining that the policy adjustment by the MPC aims to balance inflationary concerns while sustaining growth momentum. – The Goat Media Centre

https://www.facebook.com/share/mLdiTQTxS7puwokN/?mibextid=oFDknk