BOZ makes covid-19 a serious point of reference, still seeking of ways to achieve economic balance!

Notice: Undefined index: catFilterList in /home/zambi/public_html/wp-content/plugins/wp-likes/api.php on line 243

Zambian Kwacha

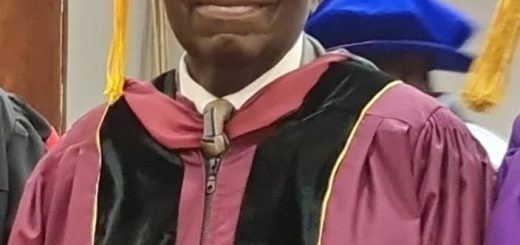

Bank of Zambia Governor Dr. Denny Kalyalya (centre)

BOZ makes covid-19 a serious point of reference, still seeking of ways to achieve economic balance!

By Kelvin Chisanga

In today’s third quarter Monetary Policy Rate announcements, the Bank of Zambia governor Dr. Denny Kalyalya hinted on the reduction of the policy rate to 8.0% due to subdued economic activities recorded in the second quarter following a number of cases owing to supply chain and trade disturbances caused by the global pandemic of COVID-19.

The BOZ chief economist mentioned that the committee sat to arrive at this figure following a number of efforts looked at among them is the need to put safety measures on financial stability, project on a steady inflation, people’s lives and livelihoods in the wake of the COVID-19 pandemic.

This reduction in monetary base rate has further been necessitated by the poor performances seen contrarily to the projections that were made at the last MPC meeting.

In the monetary presentations the following were clearly made noticeable as we saw the increment of domestic credit overflow from Government on the account of repayments, the central government was seen participating a huge portion in the domestic credit outflow as it outnumbered the private sector participation due to industry shutdown, supply chain disturbances and reduced economic performances.

Moreover, as the trend continues, the broader market suffered heighted default risk associated with lending due to the constrained market patterns which characterized a lot of market uncertainties coupled with a depressed aggregate demand pile which brought forth induced appetite for onward lending.

It is however seriously noted that the interest rate made a visible decline and recorded the similar reductions in the commercial lending, saving and worked opposite with the treasury bills which outperformed in the previous MPC announcements though the government bonds seem to be outshining this time around as institutional and portfolio investors have appreciated long term investments following market dynamics of COVID-19.

Despite the flow of domestic credit which was highly favoured by the government, the net supply of money showed a total decline in comparison view with the similar period under review, Government has continued to account for a higher percentage of growth in credit.

It is really a tough time as the market conditions have both pressure on fiscal and monetary levels, so in order to restore macroeconomic effect and attain a sustainable economic development there is still a need for the consolidation of debts and restoration of debt sustainability serving measures which should remain a serious collaborative efforts by all concerned stakeholders.

It is very unfortunately that domestic credit is poorly structured as the money supply does not seem to be in the hands of a private sector and we are likely to continue seeing low industrial activities since we have unstable consumption which is making it very difficult to predict economic growth at the back of COVID-19 which has not been assessed up to this level today.

We are likely to see inflation keeps on fluctuating nominal figures and may not likely to see a close-up ‘feel’ to the target range as non-food and food stuff can’t show much inspiration for an economic balance which we would all want to see.

On the sad side of things, we have the low uptake and little participation seen on the K10 Billion stimulus package owing to the strict measures put in place and based on the central bank implementation coupled with a lot of uncertainty in the market, this slow paced of disbursements of secondary market bond poses a risk factor to the challenging fiscal and budgetary deficit.

On the frontier sides of foreign exchange market, the Kwacha escalated to K18.280 at the advent of reduced sovereign risk assessment coupled with valuation effects which took place earlier this year exacerbated by the aggressive negative economic impact of COVID-19.

Currently, the forex market trends seem to indicate that demand is outstripping supply due to sustained economic activities. The local market is faced with a serious trade deficit as we are out rightly experiencing trade imbalance between the export and import sector coupled with unstable demands of Copper on the international market leading to Kwacha devaluation. The net supply of forex has totally declined following low trading patterns which has negatively impacted on the local merchandisers and mining companies both having very low uptake demands or offload for US Dollar on the local market.

On the positive side, we have witnessed increase in the international reserves which is standing at 2.3 months of total import cover amounting to about US$1.43 billion which has seen an increase of 2.1% at the back of statutory obligations done from the mining receipts.

The positive nature with today’s central bank low policy rate speaks directly into some lower interest rates on the cost of borrowing which will simply means that economic activities can now easily be expanded at a cheaper rate even though the market still have some condition levels of uncertainty.

Kelvin Chisanga

…

BOZ MAKES COVID-19 A SERIOUS POINT OF REFERENCE, STILL SEEKING OF WAYS TO ACHIEVE ECONOMIC BALANCE!

By Kelvin Chisanga We’d 19 Aug 2020

IN TODAY’S third quarter Monetary Policy Rate announcements, the Bank of Zambia governor Dr Denny Kalyalya hinted on the reduction of the policy rate to 8.0% due to subdued economic activities recorded in the second quarter following a number of cases owing to supply chain and trade disturbances caused by the global pandemic of COVID-19.

The BOZ chief economist mentioned that the committee sat to arrive at this figure following a number of efforts looked at among them is the need to put safety measures on financial stability, project on a steady inflation, people’s lives and livelihoods in the wake of the COVID-19 pandemic. This reduction in monetary base rate has further been necessitated by the poor performances seen contrarily to the projections that were made at the last MPC meeting. https://www.facebook.com/1338732513/posts/10218412332323151/?app=fbl